Understand When Mobile Home Refinancing Makes Sense

There are multiple ways to save money by refinancing your manufactured home. Refinancing a home can get you a lower interest rate, reduce the term of the loan, cut your monthly payment or reduce the overall cost of financing.

So, to get started, let’s answer a few questions on the topic of manufactured or mobile home refinance.

Why Would I Want to Refinance?

Many homeowners refinance because they’re feeling the pinch in other areas. Childcare, medical bills, a kid in college, insurance premiums, the need for a new car. The list can go on. There are many reasons people begin to think about leveraging the equity in a home to balance the books.

Or, perhaps a homeowner simply wants to pay less and pocket more. There’s nothing wrong with that!

How Do I Know If Refinancing Is Right For Me?

First, determine if the potential end result of mobile home refinancing is important to you. Do you want to save a couple of hundred dollars or more per month? Is there a place that money could be better spent?

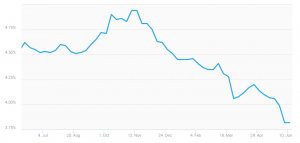

If so, take stock of where you are in your loan program and compare against current interest rates. Rates remain low, so the timing may be in your favor. Given the potential for a lower interest rate, consider how much equity you have in your home today.

What is Equity in a Home?

The equity in your home is a representation of the appraised value of your home compared with the remaining balance you need to pay on your manufactured or mobile home loan. The more equity you have, the greater the number of refinance lenders and loan products will be available to you.

The difference between the appraised value and the loan balance often is referred to as the loan-to-value ratio, or LTV.

How Much Does Credit Score Matter?

Credit score matters, but not as much as some may believe. Although lenders will look at the credit score, equal or greater weight is given to the debt-to-income ratio. And there is another reason a score alone may be deceiving. A potential borrower may have good, or even excellent credit, but a limited credit history. Ideally, you want five years of credit history. Lenders also like to see seven well-maintained open lines of credit. If you happen to be on the lower end of the spectrum, don’t worry, you have a number of options. See our guide for buying a mobile home with bad credit.

Mobile Home Loan Calculator

If you’re looking around for tools to find out how much of a difference mobile home refinance can make for you, you’re in luck. Many lenders provide manufactured home loan calculators on their website. A home loan calculator can give you a rough understanding of what a monthly loan payment might look like. You need to remember this is an estimate. Plus, you will want to have some information ready when you look up your potential costs or savings.

Items you should have available for a manufactured home mortgage calculator:

- Mortgage term

- Interest rate

- Purchase price

- Down payment

- Property taxes

- Mortgage insurance cost

Some of the mortgage calculators offered by lenders and others in the housing or home loan business provide fields specifically for refinance. However, a standard mortgage calculator will work if you simply add the information for your refinance terms and existing home information as if it was for a standard loan.

How Does Manufactured Home Refinance Save Me Money?

Monthly Bills

If all you want is a break on your monthly loan payment, the picture is pretty simple. First, take a look at the rate you pay for your loan today. If it’s higher than the rates being offered today, you may be in business. When you pay a lower interest rate, the cost to borrow is lower. That means your monthly payment will decrease, too.

Private Mortgage Insurance

Borrowers who are able to pay 20 percent or more in cash as a down payment on a mobile home loan won’t need private mortgage insurance, or PMI. However, people looking to buy a mobile home or manufactured home who are unable or unwilling to put down 20 percent of the purchase price of the home at closing will be required to obtain private mortgage insurance.

Private mortgage insurance is set up for the borrower. It costs about 0.5 to 1 percent of the loan amount. So if you have a loan for $74,000 (the average cost of a new manufactured home), you may have to pay about $20 per month in PMI, until approximately 22 percent of the loan principal is paid.

What we’re getting at here is if your home refinance plan lowers the cost of the loan to a point where you’re 22 percent or more paid in, you should be able to drop the private mortgage insurance and save that monthly payment.

Term of the Loan

Homeowners refinance for a variety of reasons. Often times, the homeowner is looking for more bang for the buck rather than reduced monthly bills. If this is you, the term of your loan might be worth considering. If you can get a lender to refinance the balance of your 30-year loan into a fixed 15-year loan, the monthly payments may be about the same under a new rate, but financing costs with the shorter term (number of years) will be much more affordable overall.

Are You Refinancing From a Chattel Loan to a Mortgage?

Converting from chattel, or personal property loan, to a mortgage is one of the primary reasons people look into mobile home refinancing. A traditional mortgage, even one with a 15-year term, can have significantly lower interest rates than a chattel loan.

While risk assessments are changing in favor of manufactured homeowners, many lenders continue to value a traditional mortgage over chattel lending because of the ease of recourse in the event there is a loan default. In other words, a manufactured home affixed to an approved foundation on a piece of land owned by the homeowner provides more security for the lender. Hence, the rate will be lower.

Converting a Personal Property Title for Your Manufactured Home

In order to be considered for a mortgage, the personal property title for your home will need to be changed to a real estate title. A title agency or real estate attorney can assist with this process. The primary component when converting a manufactured home to real estate is providing proof of ownership for both entities. You will need a certificate of title or a manufacturer’s certificate of origin to prove you are the homeowner. Additionally, you need to provide a land deed in your name for the property with an approved foundation where the home will reside. When that process is complete, you will be able to take your real estate title to the bank or other lending institution.

Options Beyond Conventional Mortgages When Refinancing a Manufactured Home

Some lenders offer a reverse mortgage for a manufactured home, or a cash-out refinance for manufactured homes. These mobile home refinance options come with added protection and can be more difficult to obtain. However, they’re worth the try if you have enough equity and want cash to complete home improvements, for instance.

What Lenders Participate in Manufactured and Mobile Home Refinance?

All the lenders with the greatest interest in the manufactured housing industry will offer some form of refinancing for manufactured homes. These include 21st Mortgage Corp., Cascade Home Loans, Triad Financial Services, Credit Human, CountryPlace Mortgage, and others. In addition, these and many other lenders participate in programs with secondary market products provided by FHA, USDA, VA, Freddie Mac and Fannie Mae.